Unknown Facts About Clark Wealth Partners

Table of Contents7 Easy Facts About Clark Wealth Partners ShownClark Wealth Partners Things To Know Before You Get ThisClark Wealth Partners - The FactsMore About Clark Wealth PartnersAll about Clark Wealth PartnersLittle Known Questions About Clark Wealth Partners.How Clark Wealth Partners can Save You Time, Stress, and Money.

The world of financing is a complex one. The FINRA Structure's National Ability Study, as an example, recently discovered that virtually two-thirds of Americans were incapable to pass a basic, five-question financial proficiency test that quizzed individuals on subjects such as interest, financial obligation, and other reasonably fundamental ideas. It's little marvel, after that, that we typically see headlines regreting the inadequate state of many Americans' financial resources (st louis wealth management firms).In addition to managing their existing customers, financial consultants will certainly frequently invest a reasonable quantity of time each week conference with potential clients and marketing their solutions to keep and grow their company. For those taking into consideration ending up being an economic consultant, it is necessary to take into consideration the average salary and task stability for those functioning in the field.

Courses in tax obligations, estate planning, investments, and risk monitoring can be helpful for trainees on this course. Depending on your distinct job objectives, you may likewise need to earn specific licenses to satisfy specific clients' needs, such as dealing supplies, bonds, and insurance policies. It can also be useful to gain an accreditation such as a Certified Financial Coordinator (CFP), Chartered Financial Analyst (CFA), or Personal Financial Expert (PFS).

Our Clark Wealth Partners Ideas

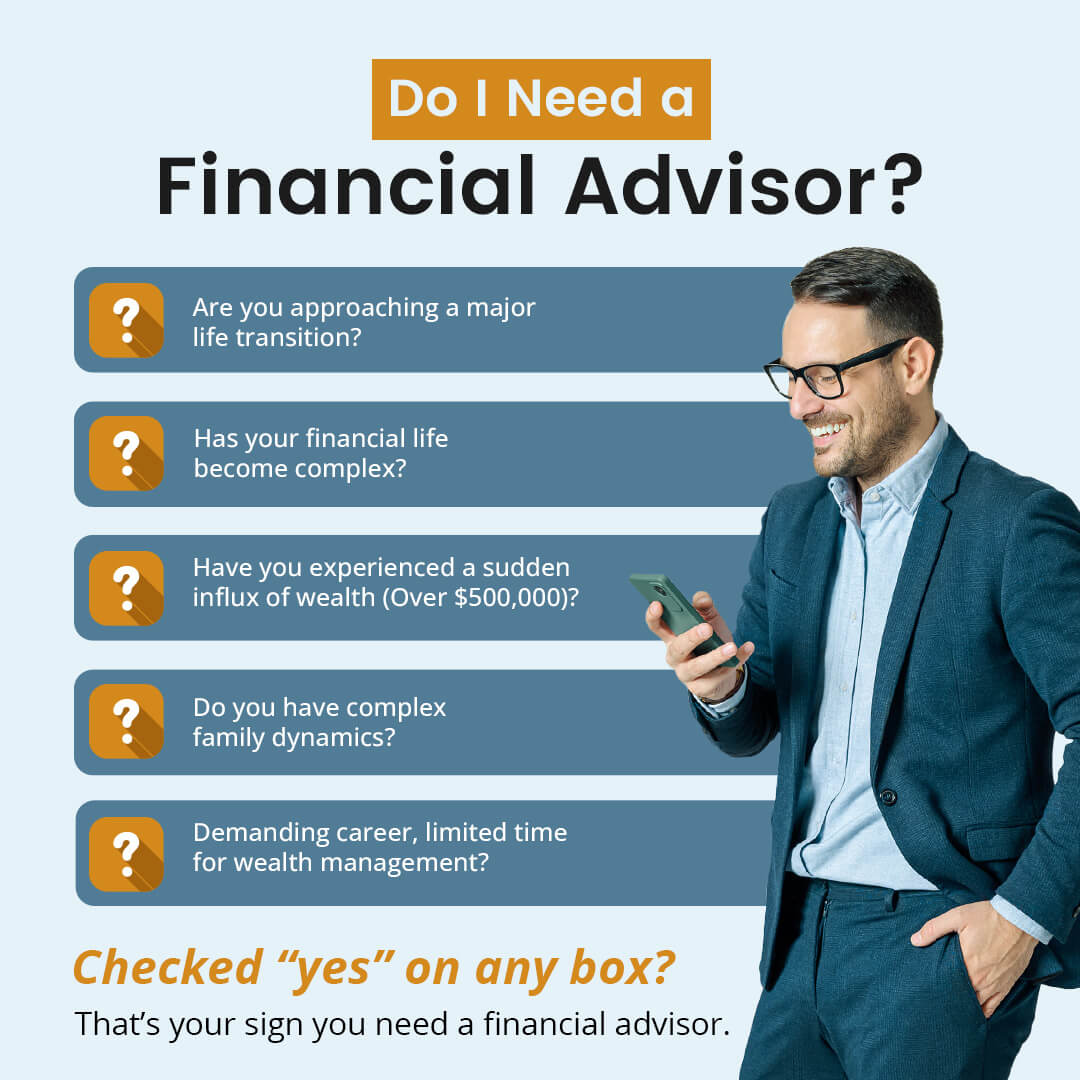

Many individuals choose to obtain aid by using the services of an economic expert. What that looks like can be a number of points, and can differ depending on your age and stage of life. Before you do anything, study is essential. Some individuals worry that they require a certain quantity of cash to spend prior to they can get help from a professional.

Facts About Clark Wealth Partners Revealed

If you haven't had any kind of experience with a monetary consultant, here's what to expect: They'll begin by giving a comprehensive analysis of where you stand with your properties, obligations and whether you're meeting benchmarks contrasted to your peers for financial savings and retired life. They'll review brief- and lasting objectives. What's handy regarding this step is that it is individualized for you.

You're young and functioning full time, have an auto or two and there are trainee fundings to pay off.

The smart Trick of Clark Wealth Partners That Nobody is Discussing

You can talk about the following best time for follow-up. Before you start, inquire about pricing. Financial advisors typically have various tiers of rates. Some have minimum asset levels and will charge a fee generally several thousand dollars for creating and readjusting a plan, or they might charge a level charge.

Always review the fine print, and make sure your economic advisor complies with fiduciary standards. You're expecting your retirement and helping your children with higher education and learning expenses. A financial advisor can supply advice for those scenarios and even more. Most retirement offer a set-it, forget-it choice that designates possessions based on your life stage.

Some Known Factual Statements About Clark Wealth Partners

That may not be the most effective way to keep building riches, particularly as you progress in your profession. Schedule routine check-ins with your planner to tweak your strategy as needed. Stabilizing cost savings for retirement and college expenses for your youngsters can be difficult. A financial consultant can help you prioritize.

Thinking of when you can retire and what post-retirement years may resemble can produce problems about whether your retirement cost savings remain in line with your post-work strategies, or if you have conserved sufficient to leave a tradition. Assist your financial specialist comprehend your strategy to cash. If you are much more traditional with conserving (and potential loss), their suggestions should react to your worries and worries.

Clark Wealth Partners for Beginners

Planning for health and wellness care is one of the big unknowns in retirement, and a monetary specialist can lay out options and recommend whether added insurance coverage as protection may be practical. Before you begin, try to obtain comfortable with the idea of sharing your entire financial photo with a specialist.

Giving your specialist a full image can assist them produce a strategy that's focused on to all parts of your economic condition, especially as you're fast approaching your post-work years. If your financial resources are straightforward and you have a love for doing it yourself, you Homepage may be great on your own.

A financial expert is not only for the super-rich; anybody facing major life changes, nearing retirement, or sensation overwhelmed by monetary choices might take advantage of specialist assistance. This post discovers the duty of economic consultants, when you might need to speak with one, and crucial considerations for selecting - https://www.robertehall.com/profile/blancarush6565041/profile. An economic advisor is a skilled professional who assists clients manage their finances and make notified decisions that straighten with their life goals

Get This Report on Clark Wealth Partners

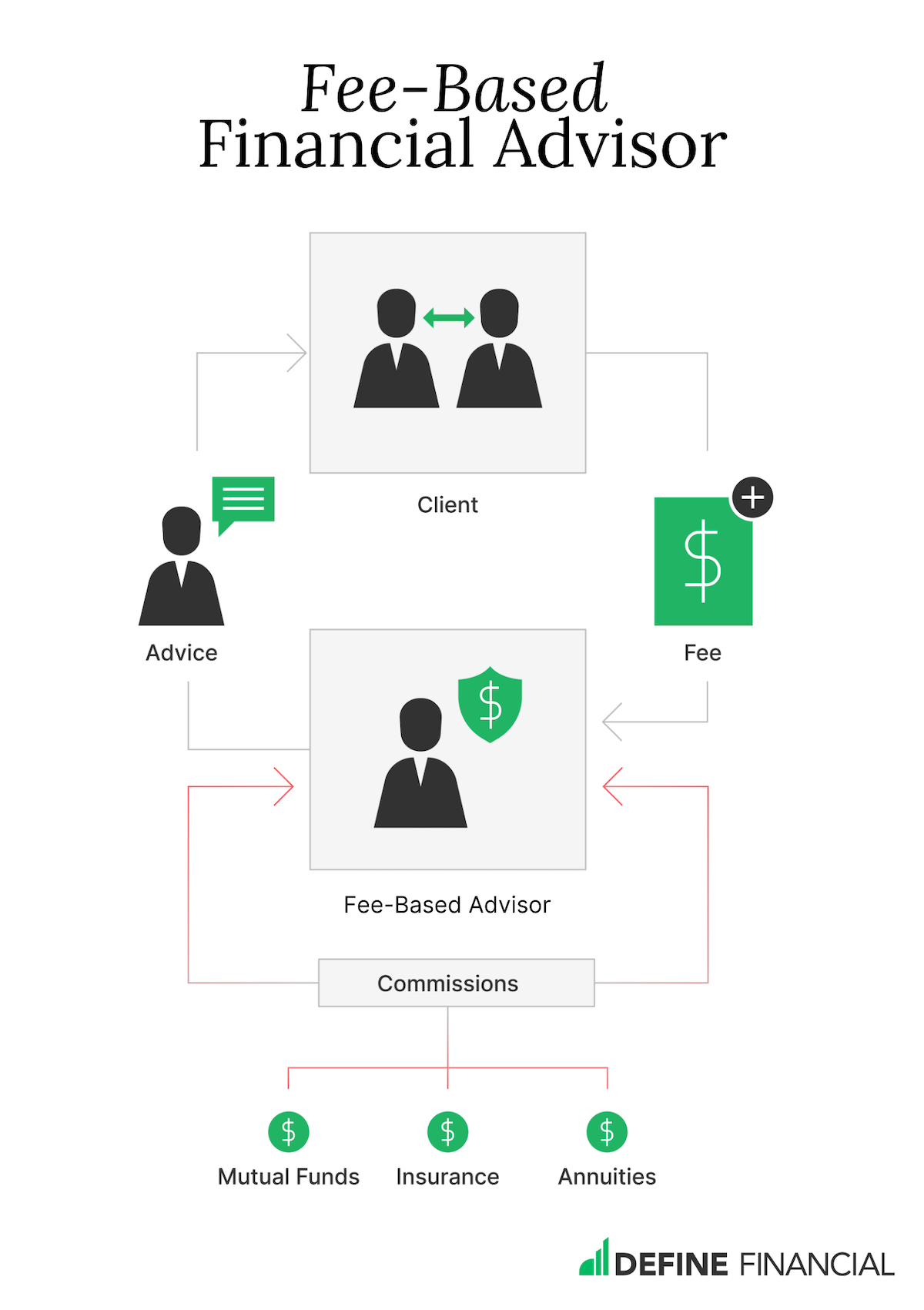

In contrast, commission-based consultants earn earnings with the economic items they sell, which might influence their suggestions. Whether it is marital relationship, separation, the birth of a kid, profession adjustments, or the loss of a liked one, these events have special financial implications, commonly requiring prompt decisions that can have long-term impacts.